About Us

Guiding Australians Through Financial Challenges with Expertise and Compassion

Why We Do What We Do

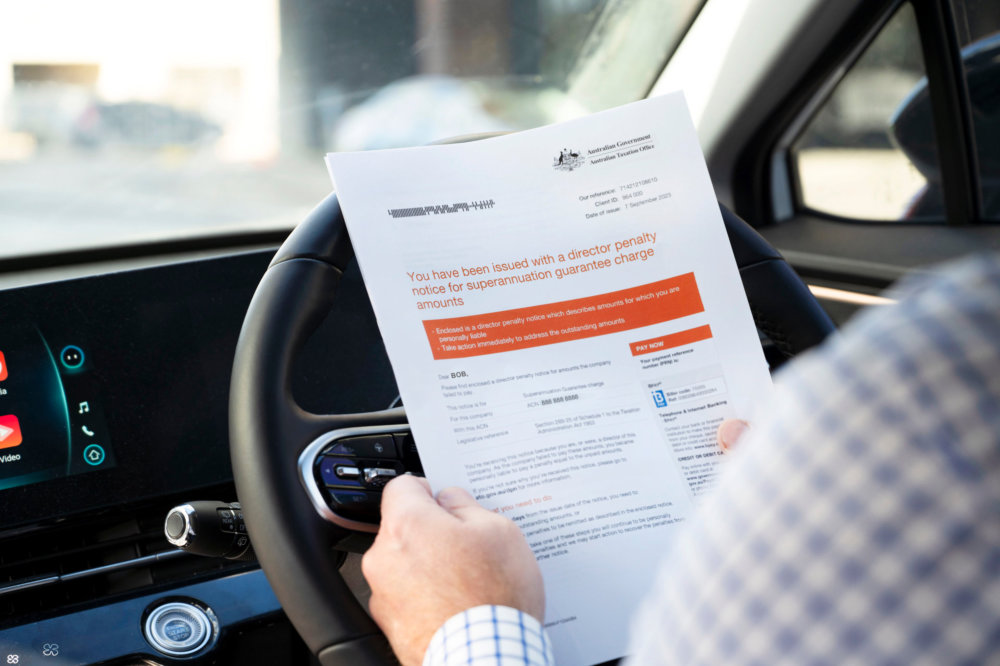

In the complex world of finance and business, insolvency stands out as one of the most challenging and emotionally charged experiences an individual or company director can face. It’s a time of uncertainty, stress, and often, confusion. Whilst liquidators play a crucial role in the insolvency process, their fiduciary duty lies with the company’s creditors, not the directors or individuals involved.

This is where LemonAide steps in. We exist to be a guiding light for Australian Directors and Individuals who find themselves grappling with significant debt in their company, business, or personal life. Our mission is to provide clarity, support, and practical solutions during what can be one of the most difficult periods in a person’s life.

We understand that behind every financial struggle is a human story – dreams of business success, personal aspirations, and often, the weight of responsibility for employees and family members. That’s why we approach each case with empathy, understanding, and a commitment to finding the best possible outcome.

Who We Serve and How

LemonAide is dedicated to helping Australian Directors and Individuals who are facing debt issues. Our clients come from all walks of life and various industries, but they share a common need: expert guidance to navigate their financial challenges and find a path forward.

We pride ourselves on our holistic approach to debt resolution. Rather than viewing insolvency as an inevitable end, we see it as one of many potential tools in a broader strategy. Our goal is always to save businesses and homes, using legal and ethical methods that align with Australian law and our own strict code of ethics.

Our strategies are tailored to each client’s unique situation. In some cases, this may involve restructuring a business to make it viable again. In others, it might mean negotiating with creditors to reach a manageable repayment plan. And yes, sometimes an insolvency event is the best course of action. However, when this happens under our guidance, we ensure that it has the minimal possible impact on our client’s life and future prospects.